As the stablecoin market surpasses $200 billion in market capitalization, the race to unlock scalable, sustainable yield mechanisms in decentralized finance (DeFi) is heating up. CAP emerges as a key contender, introducing a novel protocol that positions itself not just as another yield farm, but as a decentralized, interest-bearing stablecoin yield engine—designed for real scalability, real returns, and real risk management.

What Is CAP?

CAP is a decentralized protocol designed to issue cUSD, a stablecoin backed by USDT and USDC deposits. But what sets it apart from traditional DeFi models is its structural emphasis on covered yield at scale. Rather than relying on circular economies of token emissions or user fees—approaches that often lead to unsustainable incentives—CAP taps into exogenous yield sources using a network of professional operators and institutional strategies.

Institutional-Grade Yield Generation

At the heart of CAP is a unique operator layer, a curated group of skilled professionals including HFT firms and private credit institutions. These operators are tasked with generating yield across both crypto-native and traditional finance arenas. This multi-source approach opens up access to yield streams previously reserved for institutional insiders, bringing them to the onchain masses.

By bridging traditional and decentralized finance, CAP aims to democratize access to competitive, sustainable yield—offering DeFi users exposure to sophisticated strategies without having to manage them directly.

Dual Commitments: Yield and Risk Coverage

CAP makes two foundational promises:

- Perpetual, competitive yield for cUSD holders.

- Risk coverage for all yield-generating activities.

To underwrite this risk, CAP introduces a shared security model powered by cryptocurrency restaking. Marketplaces like EigenLayer allow restakers to provide coverage for operator activities and earn premiums in return. Meanwhile, the solvency of cUSD is supported through ETH and stETH-based restaking delegations, aligning incentives between all parties involved.

Reliable Infrastructure: Chainlink Integration

To maintain the integrity of its cUSD minting mechanism, especially during market volatility, CAP relies on Chainlink Price Feeds on Ethereum mainnet. Chainlink was selected for its proven resilience and widespread adoption in securing high-value smart contracts across DeFi.

The integration ensures that cUSD is minted based on accurate, volume-weighted market prices fetched offchain and delivered onchain—supporting both operational integrity and institutional trust.

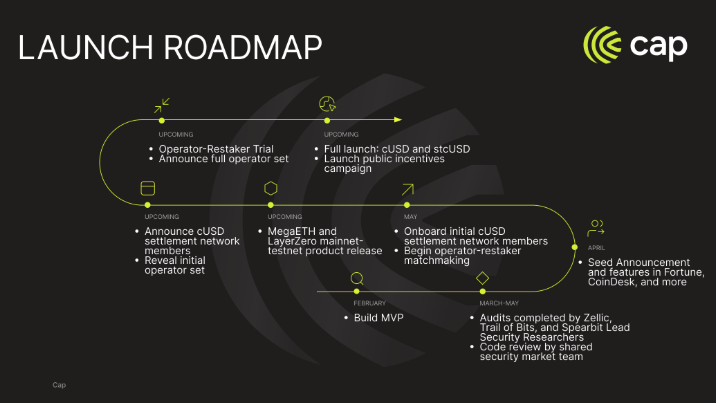

Funding and Roadmap

CAP recently raised $11 million to accelerate its development, including:

- An $8 million seed round led by Franklin Templeton and Triton Capital

- Contributions from GSR, Flow Traders, Laser Digital, IMC, and others

- A $1.1 million community round partially conducted on the Echo platform

This funding will support CAP’s planned mainnet launch later this year, solidifying its infrastructure and expanding integrations with restaking ecosystems and institutional partners.

A New Chapter for Stablecoins

CAP’s approach arrives as both governments and financial institutions explore stablecoin technologies of their own. As more capital enters this space, the need for scalable, secure, and yield-generating stablecoin systems is growing. CAP is strategically positioned to meet that demand—offering users a frictionless way to earn passive income, access advanced strategies, and participate in the next phase of decentralized finance.

Để lại một bình luận